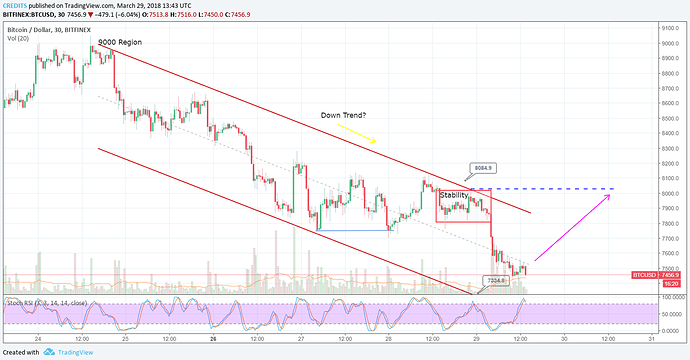

Bitcoin has fallen underneath the $7600 stamp out of the blue since March 19. Prior today, the cost of bitcoin dropped to $7500, in the wake of cresting at $8100 under 20 hours back. On the off chance that the value breaks underneath with a day by day close, encourage incautious bearish force is normal. At present, there has been some news about crypto mining in a few urban areas like New York and Plattsburgh. Plus, Twitter declared a restriction on the notice of digital currencies in any structures. No big surprise this changed the market feeling about bitcoin to bearish. Another terrible news is that bitcoin mining is likewise getting more costly than before that prompted shutting certain bits of bitcoin mining and the benefit proportion has been influenced. With respect to the present situation, the cost is making incautious moves inside the bearish pattern. An every day close underneath $7500 will uncover the danger of further indiscreet bearish weight in the coming days. As the value stays underneath $8500 with an every day close, the bearish inclination is relied upon to proceed. The cryptographic money investors group saw the dispatch of the bitcoin prospects advertise as an idealistic advancement for the worldwide digital currency, as the investors group trusted it would prompt a surge in volumes and enhance the cryptocurrency liquidity. Link

CREDITS (“CS”) on the KuCoin trade, you can see that right when the market for Bitcoin and Ethereum remain on the spot, “CS” took dynamic buys, last day trading went up to 30% and due to this reason many funds get interested to invest in CREDITS for the better security of their money. In this down market trend “CS” tokens still holds the position to be in up trend and shows a green signal to all the investors to buy and invest in it. After the listing of new exchanges it is still getting better day by day and sooner it will give a raise upto 500% when the beta version of the platform will be released.