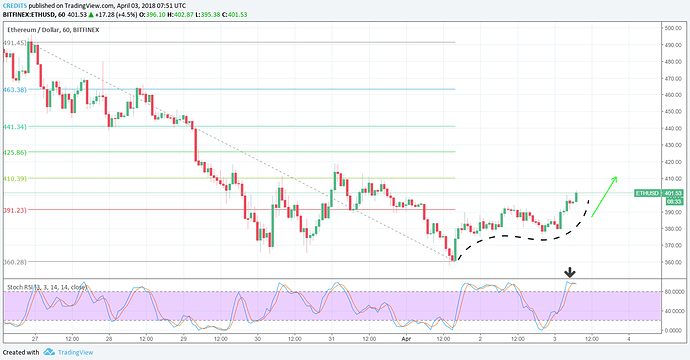

ETH cost is right now merging misfortunes with a slight bullish edge above $375 against the US Dollar. There is a noteworthy bearish pattern line framing with protection at $392 on the hourly graph of ETH/USD. The combine needs to move over the $395 protection and the 100 hourly basic moving normal to pick up upside energy. The price is at present combining misfortunes against the US Dollar and Bitcoin. ETH/USD must penetrate the 100 hourly SMA to stay in a positive zone.

The bulls are attempting to guard the $355 to $385 bolster zone on Ethereum. Indeed, even at such basic backings, there is absence of purchasing, which demonstrates shortcoming. There was a better than average help shaped over the $350 level in ETH cost against the US Dollar. The cost began an upside remedy and exchanged over the $375 level. It likewise prevailing with regards to moving past the 23.6% Fib retracement level of the last drop from the $465 high to $360 low. Notwithstanding, the upside wave is as of now confronting a noteworthy hindrance close to the $392-395 levels.

It appears like the 100 hourly straightforward moving normal is going about as a key protection close $395. In addition, there is a noteworthy bearish pattern line shaping with protection at $392 on the hourly diagram of ETH/USD. Over the pattern line protection, the 38.2% Fib retracement level of the last drop from the $405 high to $360 low is close to the $400 level. A break and close over the pattern line protection, $395 and the 100 hourly SMA may open the entryways for more picks up. The following protection could be the 61.8% Fib retracement level of the last drop from the $405 high to $360 low at $425. In the event that the value neglects to break the $395 protection and 100 hourly SMA, there could be a drawback response. For this situation, the cost could even break the $360.40 low for more decreases in the close term.

Coinbase declared today it’s aim to add ERC20 support to a few of its suite of items and also another UK Fintech Settles Security on Ethereum Blockchain in a World-First with Microsoft. The blockchain has quite recently upset another specialty. UK-based Nivaura in organization with Microsoft’s Azure cloud has demonstrated in an experiment that the general population record can be utilized to help directed resources. The blockchain is an undeniably alluring alternative as the installments business keeps on grasping cryptographic forms of money and even computerized fiat cash.

CREDITS (“CS”) on the KuCoin trade, you can see that right when the market for Bitcoin and Ethereum remain on the spot, “CS” took dynamic buys, stability in the cryptomarket has been shown on the KuCoin exchange, due to this reason many funds get interested to invest in CREDITS for the better security of their money. In this down market trend “CS” tokens still holds the position to be in up trend and shows a green signal to all the investors to buy and invest in it. After the listing of new exchanges it is still getting better day by day and sooner it will give a raise upto 500% when the beta version of the platform will be released. As, it is going to be listed on CoinBene today. Keep an eye on it.